December 3, 2025

On Pointe Podcast: Helping Family Offices Make Smart Aviation Decisions

Read More

Back in the first quarter of this year, the world had changed. Now, with three quarters under our belts, I’m excited to share some thoughts with you on the pre-owned aircraft market.

You're welcome to watch this video, or read the following blog...

For starters, we’re busy. And as I speak to other aircraft dealers around the world, including the IADA group, the same is true for them. I’ve been hearing it for many months now. While the data do not always suggest this, I will tell you that everybody is slammed right now.

So, what’s our assessment of what’s happened and what’s going to happen? What’s selling and who’s buying? And what factors are influencing pricing and value? Let’s take a look.

At Guardian Jet, we have two distinct customer groups: corporations and high-net-worth individuals. They differ in significant ways.

As I’m sure you’ve heard, most corporate flight operators are much slower. Flight hours are down significantly over last year.

This corresponds with a drop in the buying and selling of airplanes. And we haven't seen a big sell-off of corporate assets yet (nothing like what we saw in 2009). But, we have seen a few companies try to accelerate getting out of leases that are coming due in a year.

What we are seeing is that most corporations are taking a wait-and-see attitude. They want to understand how things develop before they buy or sell. We're now talking about our first “fleet swap” of the year, so there’s a glimmer of change on the horizon. But for the most part, the corporate world is moving pretty slowly.

But talk about a contrast: the high-net-worth individual world has taken off. And, for that, I give a lot of credit to our sales force, which is bringing in a lot of new customers. Some are first-time buyers and others are people upgrading their airplane. And because of this pickup, our airplane transactions will be close to what they were last year.

I want to point out what’s driving the pre-owned aircraft market for the high-net-worth individual. And the biggest factor is value.

These things are true: there’s never been a better time to buy a pre-owned airplane. And we’ve never seen more value and lower prices on the used market than we see today.

At the end of 2019, we told customers to maybe slow down and wait to buy a plane in 2020. That’s because we saw rising inventories of pre-owned aircraft, and slowing rates of sale. So we went into this year thinking there would be a softening of prices.

And then COVID-19 came along.

While value is the biggest driver for buying planes right now, we can't ignore the “coronavirus effect.”

And that’s simple: as an outcome of the virus, a lot of people don't want to get on the airlines. So first-time buyers are buying in record numbers. And they’re buying across the spectrum—from light to ultra-long-range jets.

Another factor driving the business is the number of people who are upgrading. In fact, there are more of them than there are first-time buyers.

Let’s look at the value in this kind of transaction. For every dollar you lose on selling a $3M airplane, for instance, you gain $2M by upgrading to a $6M airplane. So the notion of upgrading and saving money is at play.

But I also think there's a psychologic development occurring as a result of COVID. People are making it a point to do what they've always wanted to do. For example, we're getting more requests for the airliner type business. That means we're buying large-cabin, ultra-long-range airplanes for our customers.

All this is well and good. But we do need to look at how our current situation is affecting (or will affect) residual values.

If we examine fluctuations in the 130 markets that we track, we note that the number of airplane transactions is down about 13 percent year over year. (This is everything from the TBM to the Global 7500, and now the G700).

Remember, last year the number of transactions dropped about the same amount over the year before. So we're looking at a 25- to 30-percent drop in the last two years.

Now, the fourth quarter is still to up in the air—and we usually have a big fourth quarter—but we think that it should normalize in the end. However, we have to consider that we've seen a September to September drop in transactions of about 13 percent.

Interestingly, there has also been a corresponding drop in residual values. Anytime we see inventories increase and the rate of sales slow down, we see a softening of price.

Airplane markets are so thinly traded that you don't always see changes like these immediately. But over time, it's hard to beat Economics 101. So, in a nutshell, during COVID, there are fewer transactions and residual values have dropped.

Throughout March, April and May—with COVID—we were pegging the drop in values at somewhere between 15 to 20 percent. At the time, we actually saw that's what it took to sell an airplane. But it hasn't moved from there.

In some instances, values have stabilized. They might even be inching up a hair through this fourth quarter of activity. So, bottom line, we haven't seen anywhere near the 35 to 40 percent drop that we saw in 2009.

At the beginning of COVID, I had suggested to my peers that 2020 wouldn’t be 2009 all over again. At least in terms of residual values. And, thankfully, it hasn't been. But it has been very hard to predict.

One of the big differences under these circumstances though, is that the OEMs are in a lot better shape. They are wiser from having been through the 2009 financial crisis. Thus, the OEMs cut back production rates which kept them from having to discount significantly. They all played it fairly smart.

Speaking of new airplanes, there are great prices right now. There's a desire on the part of the OEMs to take more orders. But, given what they’d learned from 2009, they reined in production rates. This is especially meaningful in view of the residual value loss of 20 percent in a year’s time. (As you know, that's a pretty good hit in one year.)

Let's drill down a bit and talk about some specific airplane model markets to highlight competing market data. We’ll review the Phenom 300, the Sovereign, the Challenger 300, the G450 and the Global 6000.

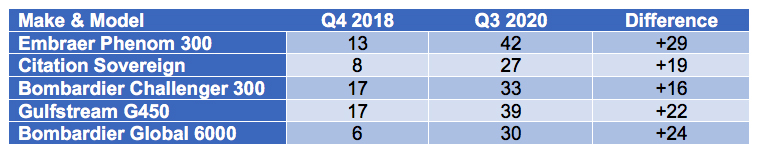

No. of Aircraft for Sale (Q4 2018 vs Q3 2020)

The numbers of these aircraft that are presently for sale help us gauge what the market is doing. Following are the dramatic increases in aircraft availability for these five markets.

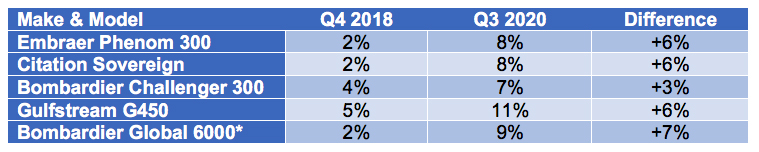

Percentage of Aircraft for Sale

As this chart indicates, inventories are increasing.

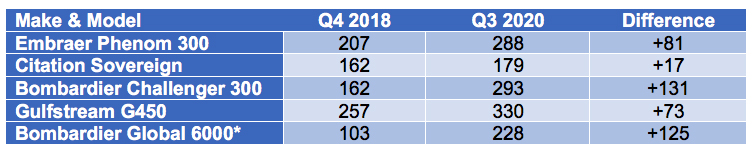

Market Duration

This chart reflects the number of days an aircraft is on the market.

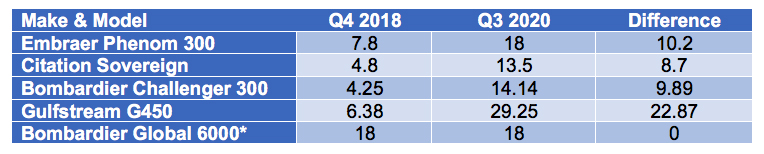

Absorption Rate

Absorption rate measures the size of an aircraft market versus the rate of sale. We calculate how many months of inventory are on the market at the current rate of sale. The absorption rate is slowing down, but by no means are we perfect yet.

These market summaries help me reiterate that we've never seen better value in the used marketplace. It's definitely not a bad time to sell, and, for that matter, a great time to replace your airplane.

When you're upgrading, you tend to save more on the side of what you're purchasing than on what you're selling. So that's what's driving the activity that we're all witnessing in the fourth quarter.

Whatever airplane(s) you have, the devil's in the details. So your market might actually be a little different than what we’ve presented. So please, if you’re seeking a little clarity or want to discuss some of the variables you’re encountering, just give me a call. We’d love to talk about these markets that we’re examining every day. One thing is certain: these are some very interesting times in our business.

With all that said, there is a lot of optimism here at Guardian Jet—especially compared to six months ago! In April—when you could hear crickets chirp around here—if you had told me the levels we’d be at now, I would have hugged you. (Something we're not allowed to do these days!) All I can say is that I'm very grateful we'll approach the same level of transactions as last year.

On behalf of the team, I hope you've stayed healthy through this. Like every other company, our priorities are to take care of the health and safety of our employees. (As well as to preserve cash and control expenses.)

As for me, I can't wait for a time when we can all get together in person again, to share ideas and compare notes. But for now, this video and blog will have to suffice!

Learn the latest about aircraft sales, brokerage trends and more.

By submitting your information, you acknowledge that you may be sent marketing material and newsletters.

Your information is secure and will never be shared with any third party. View our Privacy Policy